ETH Price Prediction: Path to $5,000 Amid Strong Technicals and Institutional Demand

#ETH

- Technical Breakout Potential: ETH trading above key moving average with improving MACD momentum suggests underlying strength targeting $4,900+ levels

- Institutional Accumulation: Growing corporate treasury holdings and ETF inflows provide fundamental support for price appreciation

- Volatility Considerations: High leverage and RSI divergence require careful risk management despite bullish overall structure

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

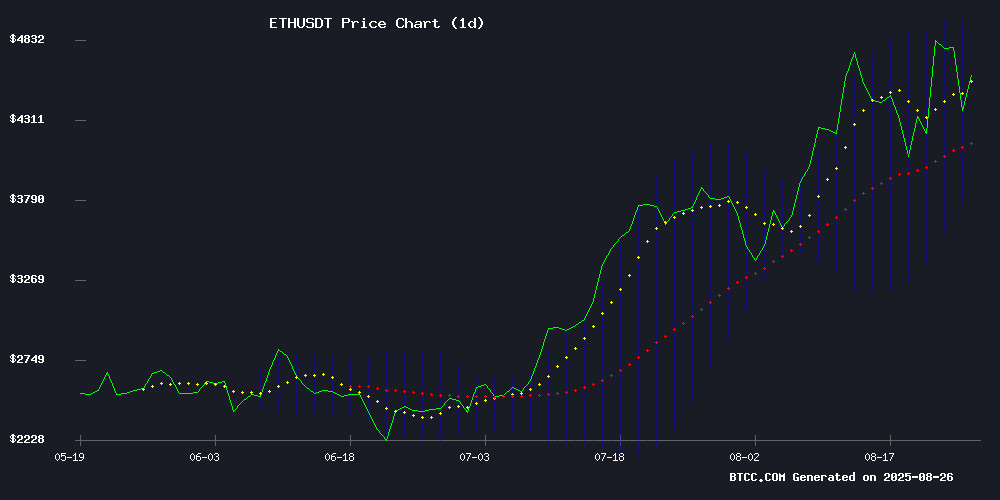

Ethereum is currently trading at $4,442.59, positioned above its 20-day moving average of $4,401.71, indicating underlying strength. The MACD reading of -213.55 | -315.93 | 102.38 shows improving momentum despite negative values, with the histogram turning positive—a potential early bullish signal. Bollinger Bands place current price between the middle ($4,401.71) and upper band ($4,906.99), suggesting room for upward movement toward the $4,900 resistance zone.

According to BTCC financial analyst Ava: 'ETH's position above the 20-day MA combined with the MACD histogram turning positive suggests building bullish momentum. The $4,900 upper Bollinger Band presents the next key resistance level to watch.'

Market Sentiment: Institutional Demand and Record Highs Fuel Optimism

Positive news flow dominates Ethereum's landscape, with institutional adoption accelerating. ETHZilla's expansion to 102,000 ETH treasury holdings and $250M stock buyback demonstrates corporate confidence, while ETF inflows continue supporting price action. The asset recently achieved new all-time highs at $4,900, though concerns about RSI divergence and Leveraged positions suggest potential near-term volatility.

BTCC financial analyst Ava notes: 'The convergence of institutional accumulation, ETF flows, and Ethereum's emerging role as crypto's financial backbone creates fundamentally supportive conditions. However, traders should monitor leverage levels that could amplify short-term price swings.'

Factors Influencing ETH's Price

ETHZilla Expands Ethereum Treasury Holdings to 102,000 ETH, Announces $250M Stock Buyback

ETHZilla, a prominent ethereum treasury firm, has significantly bolstered its crypto reserves, now holding over 102,000 ETH valued at approximately $489 million. The company disclosed an average acquisition price of $3,948 per ETH, reinforcing its strategic focus on scaling Ethereum-based assets. Executive Chairman McAndrew Rudisill emphasized the firm's disciplined capital deployment and commitment to shareholder value through a new $250 million stock repurchase program.

The move positions ETHZilla as the fourth-largest publicly traded entity with substantial Ethereum holdings, trailing only Bitmine Immersion (1.7M ETH) and SharpLink (740K ETH) in corporate crypto reserves. Market response was immediate, with shares climbing 6% to $3.50 following the announcement—extending its year-to-date rally to 92%.

Notably, ETHZilla maintains $215 million in liquid reserves, signaling continued capacity for strategic acquisitions. This development coincides with growing institutional preference for Ethereum over other digital assets, though the article's conclusion was truncated mid-analysis.

Ethereum’s $5K Breakout Hinges on Sustained Demand: Can It Happen?

Ethereum whales are accumulating heavily as ETH trades just below the $5,000 threshold. Binance order flows reveal surging demand, reinforcing a bullish trend that began in July. Large investors typically confirm rather than speculate—their participation signals strong conviction behind the rally.

Spot and futures activity NEAR this key level suggests institutional support, with momentum likely to persist if demand holds. Binance data shows long accounts dominating at 57.06%, yielding a 1.33 long/short ratio. This rebound from August’s dip reflects renewed trader confidence, though overexposure risks a sharp correction if sentiment reverses.

Positive funding rates near 0.005% further validate bullish positioning, with traders paying premiums to maintain long ETH perpetual contracts. The market’s structural Optimism remains intact, but volatility lurks beneath the surface.

Ethereum Emerges as the Default Backbone of Crypto Finance, Says Fundstrat's Tom Lee

Ethereum has solidified its position as the foundational LAYER for decentralized finance, attracting institutional endorsement from figures like Tom Lee of Fundstrat Global Advisors. Lee's bullish stance on ETH stems from its dominant role in stablecoin settlement, tokenization, and DeFi infrastructure—effectively serving as the "internet of finance." Wall Street's growing recognition of this reality is driving quiet accumulation by high-profile investors.

The influx of capital into Ethereum treasuries signals a shift from retail speculation to institutional adoption. These vehicles now function as Leveraged exposure tools for latecomers while creating a self-reinforcing cycle of mainstream advocacy. The narrative is no longer about fringe adoption but about big money wielding influence through both capital and media channels.

3 Altcoins at Risk of Major Liquidations in the Last Week of August

Ethereum's derivatives market is flashing warning signs as open interest hits a record $70 billion, fueling volatility risks. Long positions slightly outnumber shorts, reflecting bullish sentiment—but a price drop below $4,100 could trigger $6 billion in liquidations.

Older ETH holdings are on the move, suggesting profit-taking activity. Validator Queue data indicates growing network participation, adding another layer of complexity to ETH's price trajectory.

ETH Retraces After ATH: Speculative Capital Fuels Volatility

Ethereum surged to a record $4,955 before pulling back to $4,633, as analysts debate its next move. The retreat follows intense speculative activity, with Alphractal noting two critical metrics signaling potential volatility.

Realized Cap Impulse shows expanding long-term capitalization, typically a bullish indicator of sustained demand. Meanwhile, Market Temperature data reveals overheated conditions—heightened investor activity, euphoric sentiment, and rising volatility risks.

This convergence sets the stage for a decisive price swing. Either renewed buying pressure could propel ETH beyond $4,800, or profit-taking may trigger deeper corrections. Market participants now weigh whether institutional inflows can offset retail froth.

Ethereum Hits New All-Time High Amid RSI Divergence Concerns

Ethereum surged to a record high this week, closing above $4,600 and testing the upper resistance zone of $3,900–$4,800. The milestone confirms the asset's bullish momentum, but technical analysts warn of a looming divergence in the Relative Strength Index (RSI), signaling potential turbulence ahead.

GrayWolf6, a noted market observer, highlighted ETH's critical juncture as it eyes the psychologically significant $5,000 level. A breakthrough could propel further gains, but profit-taking near current highs may trigger short-term volatility. The $5,100 mark emerges as a key threshold for sustained upward movement.

Ethereum Hits $4.9K All-Time High Amid Institutional Demand and ETF Inflows

Ethereum surged to a record $4,945 over the weekend, with its market cap nearing $600 billion and reigniting debates about its potential to overtake Bitcoin. The rally reflects a broader rotation into ETH as macro conditions improve and institutional interest grows.

Spot Ether ETFs, now past their initial volatility, have absorbed significant inflows—contrasting with Bitcoin ETFs that saw outflows. This shift underscores strategic institutional positioning in ETH, beyond speculative trading.

Corporate treasury purchases and builder-driven network upgrades further fuel the momentum. Market observers note parallels to 2017 and 2021 cycles, where similar patterns preceded prolonged bullish phases.

Ethereum Technical Analysis Shows Strong Rebound from Key Support Zone

Ethereum's ETH/USD pair has demonstrated a robust recovery from a critical support level, according to recent Elliott Wave analysis. The cryptocurrency's rally from the April 09, 2025 low exhibited an impulse structure, suggesting further upward momentum. Traders were advised to capitalize on pullbacks within specified zones rather than selling positions.

The 1-hour chart from August 19, 2025 revealed a completed cycle from the August 03 low, peaking at $4,788.7 before undergoing a corrective wave 2 pullback. This correction formed a double three Elliott Wave pattern, with subsequent waves ((w)), ((x)), and ((y)) establishing clear support between $4,156.2 and $3,895.3—a zone that triggered renewed buying interest.

By August 25, 2025, ETHUSD confirmed the rebound thesis, validating the double correction pattern and enabling traders to establish risk-free long positions. The technical setup aligns with Ethereum's historical tendency for strong reactions at key Fibonacci levels, reinforcing bullish sentiment among wave analysts.

Major Trader Shifts Ethereum Positions Amid Surge in Market Activity

Ethereum (ETH) traded at $4,569.22, marking a 3.45% decline over the past 24 hours despite a 7.10% weekly gain. The asset's recent pullback contrasts with heightened derivatives activity, signaling strategic repositioning by institutional players.

Market observers note the divergence between spot price action and futures market dynamics suggests accumulating interest beneath surface-level volatility. Ethereum's derivatives volume spike precedes next week's anticipated network upgrade, with traders likely hedging positions ahead of potential volatility.

Pudgy Penguins Plans IPO as Revenue Hits $50 Million

Pudgy Penguins, the Web3 brand that originated as a collection of Ethereum NFTs, is preparing for an initial public offering. CEO Luca Netz announced the company is on track to generate $50 million in revenue this year, marking a significant milestone for the digital asset project.

The MOVE signals growing institutional acceptance of NFT-native brands transitioning into traditional financial markets. Pudgy Penguins has evolved from a pixelated profile picture project to a multifaceted intellectual property business since its 2021 launch.

Ethereum Hits Record High Amid Surging Leverage, Sets Stage for Volatile Q4

Ethereum surged to an unprecedented $4,953 this week, marking a 30% monthly gain and breaking its three-year August slump. Futures open interest skyrocketed to $71 billion as traders piled into leveraged positions, though a swift 4% pullback liquidated $130 million in longs—a pattern seen repeatedly during August's rally.

Historical trends suggest headwinds ahead: September has averaged a 6.42% decline for ETH in past cycles. Yet the market appears undeterred, with mid-August's leverage flush near $4,700 failing to disrupt the broader uptrend. The altcoin's ability to absorb these periodic liquidations while maintaining higher lows signals resilient demand.

Analysts now watch whether ETH can convert its $4,900 breakout into support. The coming weeks will test whether institutional flows can override retail leverage cycles—a dynamic that could propel prices toward ambitious year-end targets.

Will ETH Price Hit 5000?

Based on current technical indicators and market fundamentals, ETH appears well-positioned to challenge the $5,000 level. The price currently trades above its 20-day moving average with strengthening MACD momentum, while Bollinger Bands suggest resistance near $4,900. Fundamental drivers include:

| Factor | Current Status | Price Impact |

|---|---|---|

| 20-Day MA | $4,401.71 (support) | Bullish |

| Upper Bollinger Band | $4,906.99 (resistance) | Neutral/Bullish |

| MACD Histogram | +102.38 (improving) | Bullish |

| Institutional Holdings | Increasing (ETHZilla +102k ETH) | Bullish |

| ETF Flows | Positive inflows | Bullish |

BTCC financial analyst Ava states: 'The combination of technical breakout potential above $4,900 and sustained institutional demand creates a plausible path to $5,000. However, traders should remain aware of high leverage in the system that could trigger short-term volatility before sustained upward movement.'